10 min read

Content on this page is intended for information and educational purposes only and should not be considered investment advice or investment recommendation.

How to make real money with eToro broker?

Learn how to make money on eToro Broker - easy tips to blow your mind.

What many investors don't realise is how to profit with an eToro broker. When it comes to online Forex trading, there are so many options that it may be a bit difficult to find out how to get started. To make money in the market quickly and easily, you may want to consider using eToro as your trading platform. Here's how to generate money using etoro broker. Trading platform eToro, which has been operational for a few years, is one of the most safe Platform-based, it may be accessed using a web browser.

In real-time, users may put bids and offers on any currencies they choose to trade. You can sign up for it for free. Despite the fact that it isn't the cheapest trading platform accessible, it is significantly highly recommended by industry experts.

In real-time, users may put bids and offers on any currencies they choose to trade. You can sign up for it for free. Despite the fact that it isn't the cheapest trading platform accessible, it is significantly highly recommended by industry experts.

What eToro is

eToro is, among multiple online trading platforms, a popular social trading website that also allows users to invest in stocks, cryptocurrencies, and trading CFDs contracts based on a variety of underlying assets. Client money are safeguarded using the most secure security techniques available. The firm has been in operation since 2007, and during that time has shown to be a trustworthy partner, providing a variety of innovative trading instruments for foreign exchange investing and trading.

The company's staff is continuously trying to provide traders with simple-to-use and cutting-edge technologies for trading on foreign exchange markets. For this aim, specialists have developed a unique trading system that is the most user-friendly for traders all over the world. Clients may connect with traders from all around the globe, follow their transactions, duplicate deals from expert traders, and trade on their own using the site.

The company's staff is continuously trying to provide traders with simple-to-use and cutting-edge technologies for trading on foreign exchange markets. For this aim, specialists have developed a unique trading system that is the most user-friendly for traders all over the world. Clients may connect with traders from all around the globe, follow their transactions, duplicate deals from expert traders, and trade on their own using the site.

eToro works with a number of investment firms, including Commerzbank, Sberbank, PingAn, BRM Group, and Spark Capital. The firm has offices in the United Kingdom, Cyprus, Australia, and the United States. The firm provides the option to join in the "Popular investor" programme. This programme is intended for traders with prior trading expertise. Popular investors may be able not only to earn some money, but also make an additional monthly income based on the number of copiers and the amount of copying capital. Not all other brokers offer such opportunities.

Benefits of eToro:

- CySEC, FCA, and ASIC regulation

- Individualized strategy

- A diverse variety of instruments

- Client money are safeguarded

- Opportunities for training

- Transparency and safety

eToro Investing assets:

Indices are a collection of stocks, generally country.

Indices are a collection of stocks, generally country. ETFs are stock portfolios that target certain industries or areas.

ETFs are stock portfolios that target certain industries or areas. CopyPortfolios is an eToro product that works similarly to stock funds, with the exception that the stocks in CopyPortfolios are chosen by experts from eToro.

CopyPortfolios is an eToro product that works similarly to stock funds, with the exception that the stocks in CopyPortfolios are chosen by experts from eToro. Stocks are a company part.

Stocks are a company part.- Commodities are investments in things like oil, gold, and sugar.

- Because they are traded on changes in the exchange rate of one currency against another, such as the euro versus the dollar, the term forex is intimately associated with currency markets.

This is what we are going to talk about now.

This is what we are going to talk about now.

eToro review - Copy Trading

Traders: Millions by the Minute, a recent BBC documentary, has extensively explored the site and the broader topic of social investment.

According to eToro reviews, CopyTrader is arguably the most distinctive feature eToro offers. That way, you can search for other investors, and see their trading history in plain sight, including how much they've gained or lost over a It's possible to automatically duplicate someone's trades if you discover someone you like.

"Popular investors" is also a plus. Users are rewarded based on the number of copiers they own through a monthly compensation system. Towards the end of the tutorial we'll go into more detail about the program's incentives for ethical trading.

Because of this, you'll learn a lot quickly! You'll learn much of what you need to know by reading this tutorial or using a trial account.

"Popular investors" is also a plus. Users are rewarded based on the number of copiers they own through a monthly compensation system. Towards the end of the tutorial we'll go into more detail about the program's incentives for ethical trading.

Because of this, you'll learn a lot quickly! You'll learn much of what you need to know by reading this tutorial or using a trial account.

Make sure you know what you're doing before you invest huge sums of money. To be honest, there is the possibility of lost money when trading on eToro, but it could also be vital to remember that there is always the possibility of making money.

Getting started – create your account

1

Set up an account on eToro:

There's no need to fill out a lot of paperwork. Your only task is to input your information and select a username. As a security measure, they ask for a phone number.

In order to really trade in real-time, you'll need to complete your profile.

In order to really trade in real-time, you'll need to complete your profile.

2

Complete your profile:

This is a crucial step in protecting your record and customising the eToro platform to your specific requirements.

The first section asks for basic personal information (to have not to input an 'Identification Number' if you're not sure).

Following that, there are a few questions on your trading experience. It's not an exam, so don't be too concerned about your answers; instead, strive to be truthful.

The first section asks for basic personal information (to have not to input an 'Identification Number' if you're not sure).

Following that, there are a few questions on your trading experience. It's not an exam, so don't be too concerned about your answers; instead, strive to be truthful.

3

Top up:

At the bottom left, click 'Continue to deposit' (or 'Deposit money').

The minimal depositing money amount is $50, which is ideal for beginning started investing.

It should be noted that the main currency of eToro is $USD, but you may deposit in £GBP and other significant currencies as well. In your account, it will also be converted to $USD.

The minimal depositing money amount is $50, which is ideal for beginning started investing.

It should be noted that the main currency of eToro is $USD, but you may deposit in £GBP and other significant currencies as well. In your account, it will also be converted to $USD.

4

Familiarizing yourself with the platform:

For the time being, we'll only give you a short tour of the key areas of eToro. We'll go over each one in depth later when we teach how to explore and trade.

1

Set up an account on eToro:

There's no need to fill out a lot of paperwork. Your only task is to input your information and select a username. As a security measure, they ask for a phone number.

In order to really trade in real-time, you'll need to complete your profile.

In order to really trade in real-time, you'll need to complete your profile.

2

Complete your profile:

This is a crucial step in protecting your record and customising the eToro platform to your specific requirements.

The first section asks for basic personal information (to have not to input an 'Identification Number' if you're not sure).

Following that, there are a few questions on your trading experience. It's not an exam, so don't be too concerned about your answers; instead, strive to be truthful.

The first section asks for basic personal information (to have not to input an 'Identification Number' if you're not sure).

Following that, there are a few questions on your trading experience. It's not an exam, so don't be too concerned about your answers; instead, strive to be truthful.

3

Top up:

At the bottom left, click 'Continue to deposit' (or 'Deposit money').

The minimal depositing money amount is $50, which is ideal for beginning started investing.

It should be noted that the main currency of eToro is $USD, but you may deposit in £GBP and other significant currencies as well. In your account, it will also be converted to $USD.

The minimal depositing money amount is $50, which is ideal for beginning started investing.

It should be noted that the main currency of eToro is $USD, but you may deposit in £GBP and other significant currencies as well. In your account, it will also be converted to $USD.

4

Familiarizing yourself with the platform:

For the time being, we'll only give you a short tour of the key areas of eToro. We'll go over each one in depth later when we teach how to explore and trade.

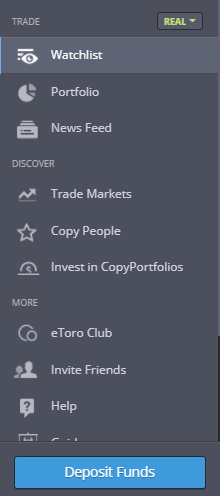

The left menu on eToro platform

Watchlist

Organize the individuals and markets in which you want to emulate or invest. You may make other lists, such as 'promising stocks' and traders to copy.'

Portfolio

The central nervous system of your investing journey. View all of your open trades with live tickers and values, and track your progress.

News Feed

This is similar to your Facebook News Feed, where you can see what the traders you follow have been doing and saying recently.

Trade Markets

The place to research and trade in the markets open to you: equities (for example, Apple), currencies (for example, GBP/USD), commodities (for example, gold), indices (for example, UK100), and ETFs.

Copy People

The community's beating heart. Other traders you may wish to emulate or follow may be found on the Internet Useful criteria, such as markets and performance, might not let widen your search results.

Organize the individuals and markets in which you want to emulate or invest. You may make other lists, such as 'promising stocks' and traders to copy.'

Portfolio

The central nervous system of your investing journey. View all of your open trades with live tickers and values, and track your progress.

News Feed

This is similar to your Facebook News Feed, where you can see what the traders you follow have been doing and saying recently.

Trade Markets

The place to research and trade in the markets open to you: equities (for example, Apple), currencies (for example, GBP/USD), commodities (for example, gold), indices (for example, UK100), and ETFs.

Copy People

The community's beating heart. Other traders you may wish to emulate or follow may be found on the Internet Useful criteria, such as markets and performance, might not let widen your search results.

How exactly to make money on eToro

The three major methods of also earns money on eToro will be discussed now that you're part of the community and have studied the site a little.

— Imitating other successful traders (Copy People)

Investment on eToro has never been easier. As a result of copying someone else's trades, every deal they make opens in your account at the same time

In the end, the earns money will go a same rate of return as they do, regardless of how much of your overall account's money are allocated to them (more on this later).

Copying eToro traders isn't always as easy as it seems. Find out what you should be on the lookout for and what not to do (more on this later on). Permit us to assist you in becoming a master of copy dealing.

In the end, the earns money will go a same rate of return as they do, regardless of how much of your overall account's money are allocated to them (more on this later).

Copying eToro traders isn't always as easy as it seems. Find out what you should be on the lookout for and what not to do (more on this later on). Permit us to assist you in becoming a master of copy dealing.

— Maintain a strategic distance from most often maken mistakes

As a first step, let's point out the number one error that newbies make: For example, when you go to the "Copy People" area and are looking for an investor you can simply filter by "most copied" and copy the top results. People that are the most copied should have a lot of copiers, wouldn't you think? Who knows, we might call it the collective thinking.

As it turns out, though, the vast majority of eToro users are total novices who have no idea what they're Individuals who mimic traders for the wrong motives can soon become "viral", with an exponential increase in the number of people who copy them without thinking. As an example, consider the following.

As it turns out, though, the vast majority of eToro users are total novices who have no idea what they're Individuals who mimic traders for the wrong motives can soon become "viral", with an exponential increase in the number of people who copy them without thinking. As an example, consider the following.

Illustration provided by google.com. An eToro trader who is well-known, yet lowperforming.

These traders are still being imitated even though their performance is so bad (if you had copied them, they would have lost 98% of your money over the previous five months). eToro is notorious for this, therefore we'll outline the steps to take while copy trading.

Aside from continuously underperforming traders, overtrading is another common problem for new traders. Even while it's very tempting to check your balance every few hours to see how much you've made or lost, emotions will cloud your vision and cause you to fiddle.

Every week or month, no trader will benefit, thus we propose you use a medium/long term approach. You'll need patience and discipline, but in the long run, you'll notice greater results.

Aside from continuously underperforming traders, overtrading is another common problem for new traders. Even while it's very tempting to check your balance every few hours to see how much you've made or lost, emotions will cloud your vision and cause you to fiddle.

Every week or month, no trader will benefit, thus we propose you use a medium/long term approach. You'll need patience and discipline, but in the long run, you'll notice greater results.

— Finding the most successful traders to emulate

The first step is to click on the 'Copy People' button in the eToro.

Alternatively, you may utilise the advanced search option to find potential and trending popular investors by just scrolling down the page. Change anything in blue to suit the parameters you're looking for in potential traders to imitate.

A list of matched traders will be displayed, sorted by the number of copiers each one has. There are a number of filters available to narrow down your search.

Alternatively, you may utilise the advanced search option to find potential and trending popular investors by just scrolling down the page. Change anything in blue to suit the parameters you're looking for in potential traders to imitate.

A list of matched traders will be displayed, sorted by the number of copiers each one has. There are a number of filters available to narrow down your search.

When copying a trader, look for the following:

- On their profile feed, they should really show off their market expertise.

- Have modest weekly and daily drawdowns (essentially, how much they’ve been "down" during a particular time period). In the event that the percentage exceeds 10%, it should be a negative sign.

- The returns should not be exorbitant. The advice, although it may appear counter-intuitive at first glance, is that if you see someone who has made 1,000 percent or more in a short period of time, you should realise that this is unsustainable luck.

- Don’t expect to win every time. When you finish some transactions in the red, it’s a sign of discipline and experience that you’ve put in. In contrast to novices who follow after their losses, professional dealers recognise the moment to stop.

- They are good communicators. Ideally, you’d like to be learning from some one who wishes to share their dealing strategy with a person who doesn’t respond to your communications is uninterested (and likely to trade recklessly), or they don’t know how to respond since they have no idea what they’re doing.

Overall conclusion

To protect investor money and improve diversity, eToro restricts your investment on a single trade to 40% of your total capital. The conventional diversification formula is to divide the whole amount of money into ten equal parts and invest each portion in ten different merchants. Also, the usual rule is 80/20, which means that if you want stability, invest 80% of your money in low-risk traders and 20% in medium-risk traders. If you are willing to take a chance, you can try your luck by investing 80% in medium-risk traders and 20% in high-risk traders, but be prepared to accounts lose all of the money invested in the high-risk traders, because no one has ever managed to generate a high stable income above the market, i.e. above the return on the SP500 index, over a long period of time.

For the time being, that's all we have to say, and good luck with your investments!

Note: eToro allows users to trade equities, crypto-assets, and also offers CFDs.

CFDs are complicated tools with a significant danger of losing money rapidly owing to leverage. 67 percent of retail investor accounts with this supplier lose money while trading CFDs. You ought to think about whether you understand how CFDs operate and whether you can afford to risk losing a lot of money.

Past performance does not guarantee future results.

CFDs are complicated tools with a significant danger of losing money rapidly owing to leverage. 67 percent of retail investor accounts with this supplier lose money while trading CFDs. You ought to think about whether you understand how CFDs operate and whether you can afford to risk losing a lot of money.

Past performance does not guarantee future results.

GENERAL RISK WARNING:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

87% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

87% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

OTHER BROKERS COMPARISON: