10 min read

Content on this page is intended for information and educational purposes only and should not be considered investment advice or investment recommendation.

eToro is an Israeli-based social trading and multi-asset brokerage business that specialises in financial and copy trading services, which are a great opportunity to earn money. Its registered offices are in Cyprus, the United Kingdom, the United States, and Australia. In 2018, the firm was valued $800 million, and it is anticipated to triple to $2.5 billion by 2020.

This eToro review will concentrate on eToro trading review in South Africa, covering the trading platform, terms, security, how to make money and other important aspects.

This eToro review will concentrate on eToro trading review in South Africa, covering the trading platform, terms, security, how to make money and other important aspects.

Regulation

This eToro review defines whether South African investors and traders may place their faith in eToro for the following reasons.

The parent company of eToro is eToro (Europe) Limited, a Cyprus-based financial corporation (CIF). The Cyprus Securities and Exchange Commission has granted eToro Europe Ltd a business licence (CySEC).

The parent company of eToro is eToro (Europe) Limited, a Cyprus-based financial corporation (CIF). The Cyprus Securities and Exchange Commission has granted eToro Europe Ltd a business licence (CySEC). eToro (UK) Limited, a Financial Conduct Authority-registered and authorised company, operates in the United Kingdom (FCA).

eToro (UK) Limited, a Financial Conduct Authority-registered and authorised company, operates in the United Kingdom (FCA). Both eToro UK Ltd and eToro Europe Ltd are subject to the Markets in Financial Instruments Directive (MiFID).

Both eToro UK Ltd and eToro Europe Ltd are subject to the Markets in Financial Instruments Directive (MiFID). In Australia, eToro is known as eToro AUS Capital Pty Ltd, and it possesses an Australian Financial Services License (AFSL) from the Australian Securities and Investments Commission (ASIC).

In Australia, eToro is known as eToro AUS Capital Pty Ltd, and it possesses an Australian Financial Services License (AFSL) from the Australian Securities and Investments Commission (ASIC).

The parent company of eToro is eToro (Europe) Limited, a Cyprus-based financial corporation (CIF). The parent company of eToro is eToro (Europe) Limited, a Cyprus-based financial corporation (CIF). The Cyprus Securities and Exchange Commission has granted eToro Europe Ltd a business licence (CySEC).

The parent company of eToro is eToro (Europe) Limited, a Cyprus-based financial corporation (CIF). The parent company of eToro is eToro (Europe) Limited, a Cyprus-based financial corporation (CIF). The Cyprus Securities and Exchange Commission has granted eToro Europe Ltd a business licence (CySEC). eToro (UK) Limited, a Financial Conduct Authority-registered and authorised company, operates in the United Kingdom (FCA).

eToro (UK) Limited, a Financial Conduct Authority-registered and authorised company, operates in the United Kingdom (FCA). Both eToro UK Ltd and eToro Europe Ltd are subject to the Markets in Financial Instruments Directive (MiFID).

Both eToro UK Ltd and eToro Europe Ltd are subject to the Markets in Financial Instruments Directive (MiFID). In Australia, eToro is known as eToro AUS Capital Pty Ltd, and it possesses an Australian Financial Services License (AFSL) from the Australian Securities and Investments Commission (ASIC).

In Australia, eToro is known as eToro AUS Capital Pty Ltd, and it possesses an Australian Financial Services License (AFSL) from the Australian Securities and Investments Commission (ASIC).

eToro review of Account establishing: A Step-by-Step Guide

The Sign Up button is prominently displayed at the top of the page. To get started, all you have to do is click on it. You may join up using your Google or Facebook account if you have one.

1

Fill in your Personal Information:

To make an account with them, you must first input some personal information. You must provide your phone number and email address, both of which must be confirmed.

2

Go to Account Dashboard:

You'll now be on the account dashboard, where you can see all of the features available on your eToro Live Trading account.

3

Complete your Profile:

Once you've checked your account dashboard, you'll need to fill up the information by following the directions on the page, as seen in the image below.

4

Authenticate Your Account:

Finally, you must provide an OTP to verify your phone number. You must also submit your papers, such as identification (driver's licence, passport, etc.) and proof of address (energy bill, postpaid cell bill, etc.).

1

Fill in your Personal Information:

To make an account with them, you must first input some personal information. You must provide your phone number and email address, both of which must be confirmed.

2

Go to Account Dashboard:

You'll now be on the account dashboard, where you can see all of the features available on your eToro Live Trading account.

3

Complete your Profile:

Once you've checked your account dashboard, you'll need to fill up the information by following the directions on the page, as seen in the image below.

4

Authenticate Your Account:

Finally, you must provide an OTP to verify your phone number. You must also submit your papers, such as identification (driver's licence, passport, etc.) and proof of address (energy bill, postpaid cell bill, etc.).

Now you have completed all of the steps required to open an eToro live trading account. You've also turned in your documents for account verification. In most situations, account verification might take up to 24 hours. You will be notified by email once your account has been validated.

You may join eToro as a professional or as a retail consumer. To become a professional customer, you must first pass a suitability exam. Professional clients can benefit from negative balance protection, high leverage trading, and no leverage limitations.

You may join eToro as a professional or as a retail consumer. To become a professional customer, you must first pass a suitability exam. Professional clients can benefit from negative balance protection, high leverage trading, and no leverage limitations.

eToro review – Demo account

When you open an active eToro account, you'll receive a free $100,000 demo account to use to build a virtual portfolio and practice CFD trading or social copy trading. Market prices are up to date and accurate in real time.

There is no risk while trading FX with an eToro sample account because positions are opened with 'fake' money. It's a great way for inexperienced traders to perfect their eToro trading review techniques without putting their own money to earn more.

As a retail trader, you have complete access to the eToro trading review assets of the online broker. You can trade manually or copy trades. Although retail traders have restricted leverage, they can benefit from negative balance protection and margin closeout limits.

There is no risk while trading FX with an eToro sample account because positions are opened with 'fake' money. It's a great way for inexperienced traders to perfect their eToro trading review techniques without putting their own money to earn more.

As a retail trader, you have complete access to the eToro trading review assets of the online broker. You can trade manually or copy trades. Although retail traders have restricted leverage, they can benefit from negative balance protection and margin closeout limits.

eToro review - Copy Trading

This is eToro trading review of a standout feature and what has made the firm famous in the market, and it is completely free to use. Any registered client may use the copy trader to observe the activity of individuals trading on eToro and duplicate their trades in real time. Traders may conveniently link their trades to a number of ostensibly successful traders and instantly repeat what they do as soon as they do it. According to eToro, 80 percent of replicated trades are profitable, making it appealing to novice traders in particular.

When writing this eToro review South Africa, we found out that the benefit of utilising a copy trader is that traders who have little understanding of financial trading may learn about it by watching traders who regularly perform well. Nonetheless, the copy trader provides a 'Duplicate Stop Loss' setting that allows traders to limit the risks associated with each copy transaction.

When writing this eToro review South Africa, we found out that the benefit of utilising a copy trader is that traders who have little understanding of financial trading may learn about it by watching traders who regularly perform well. Nonetheless, the copy trader provides a 'Duplicate Stop Loss' setting that allows traders to limit the risks associated with each copy transaction.

eToro review

On eToro, you may trade thousands of assets, including the following trading instruments:

- ForexIn accordance with eToro review South Africa, eToro allows you to trade 47 currency pairs, including majors (EUR/USD, GBP/USD, and USD/JPY) and minors (NZD/CAD, EUR/JPY, and USD/ZAR), but no exotics. While this is about average, many foreign brokers may provide 60 or more trading pairs, including a variety of unusual pairings. Leverage on Forex pairings may reach up to 30:1.

Stocks CFDseToro provides 2,000 stock CFDs, which is somewhat more than the industry average. Some of the biggest US corporations are represented, including Apple, Amazon, Facebook, Microsoft, and Google, among others. Leverage on share CFDs can be up to 5:1.

Stocks CFDseToro provides 2,000 stock CFDs, which is somewhat more than the industry average. Some of the biggest US corporations are represented, including Apple, Amazon, Facebook, Microsoft, and Google, among others. Leverage on share CFDs can be up to 5:1.- CommoditieseToro provides 31 commodities, which is exceptional given that most brokers only offer 5 – 10 commodities for trading. Gold, silver, platinum, petroleum, oil, and softs such as cocoa, wheat, sugar, and cotton are among them. With the exception of gold and non-major stock indexes, the maximum leverage on commodities is 10:1.

IndicesAccording to eToro review, it eToro provides trading on 13 stock indices, which is average in comparison to other comparable brokers, and includes the UK 100, SPX 500, NSDQ 100, and USD. On indexes, leverage can go up to 20:1.

IndicesAccording to eToro review, it eToro provides trading on 13 stock indices, which is average in comparison to other comparable brokers, and includes the UK 100, SPX 500, NSDQ 100, and USD. On indexes, leverage can go up to 20:1.- CryptocurrenciesWith 96 crypto pairings accessible for trading, eToro provides a larger selection than most other brokers, including crypto/crypto and crypto/fiat combinations (USD, EUR, JPY, and more). Leverage on bitcoin trading may reach a maximum of 2:1. eToro also provides cryptocurrency trading help 24 hours a day, seven days a week.

ETFseToro provides 254 ETFs for trading, which is a greater selection than most other brokers, including the iShares JP Morgan and iShares NASDAQ 100. On ETFs, leverage may reach 20:1.

ETFseToro provides 254 ETFs for trading, which is a greater selection than most other brokers, including the iShares JP Morgan and iShares NASDAQ 100. On ETFs, leverage may reach 20:1.

How to Deposit Money into an eToro Account and Withdraw Funds

Depositing money into your eToro account is straightforward. To deposit funds, log into your trading account, click the Deposit Funds link, pick your currency, enter the amount you wish to deposit, and choose your chosen deposit method. Because eToro employs the newest Secure Socket Layer (SSL) technology, making deposits is safe and secure.

Wire Transfer is a convenient way for South African traders to fund their trading accounts. It takes 3–5 days for the cash to show up in their accounts. The minimal first-time deposit ranges from $200 to $1000, with the specific amount varying depending on the nation of residency. The minimum deposit amount is $50 for all future deposits, however it is $500 for wire transfers.

Depositing money into your eToro account is straightforward. To deposit funds, log into your trading account, click the Deposit Funds link, pick your currency, enter the amount you wish to deposit, and choose your chosen deposit method. Because eToro employs the newest Secure Socket Layer (SSL) technology, making deposits is safe and secure.

Wire Transfer is a convenient way for South African traders to fund their trading accounts. It takes 3–5 days for the cash to show up in their accounts. The minimal first-time deposit ranges from $200 to $1000, with the specific amount varying depending on the nation of residency. The minimum deposit amount is $50 for all future deposits, however it is $500 for wire transfers.

Wire Transfer is a convenient way for South African traders to fund their trading accounts. It takes 3–5 days for the cash to show up in their accounts. The minimal first-time deposit ranges from $200 to $1000, with the specific amount varying depending on the nation of residency. The minimum deposit amount is $50 for all future deposits, however it is $500 for wire transfers.

eToro exclusively accepts USD as a payment method, although traders are allowed to deposit in their own currency. eToro charges a foreign currency translation fee and transforms their deposits into USD at the current exchange rate.

Withdrawals are available to South African dealers using the following methods:

Using a Credit Card

Using a Credit Card Bank Transfer

Bank Transfer Through PayPal

Through PayPal

Withdrawals are available to South African dealers using the following methods:

- Using a Credit Card

- Bank Transfer

- Through PayPal

Payouts are processed within one banking day by the online broker, however withdrawal times vary depending on the withdrawal type. The withdrawal time frame for credit/debit cards and wire transfers is up to 8 banking days, according to a chart on the eToro review website, while the withdrawal time frame for electronic wallet services like WebMoney, PayPal, Neteller, and Skrill is 1 – 2 banking days.

At a minimum, clients should withdraw $50 at a time. They also can't seek a payment until their accounts have been verified. Traders who withdraw more over US$50 must incur a US$25 withdrawal charge.

At a minimum, clients should withdraw $50 at a time. They also can't seek a payment until their accounts have been verified. Traders who withdraw more over US$50 must incur a US$25 withdrawal charge.

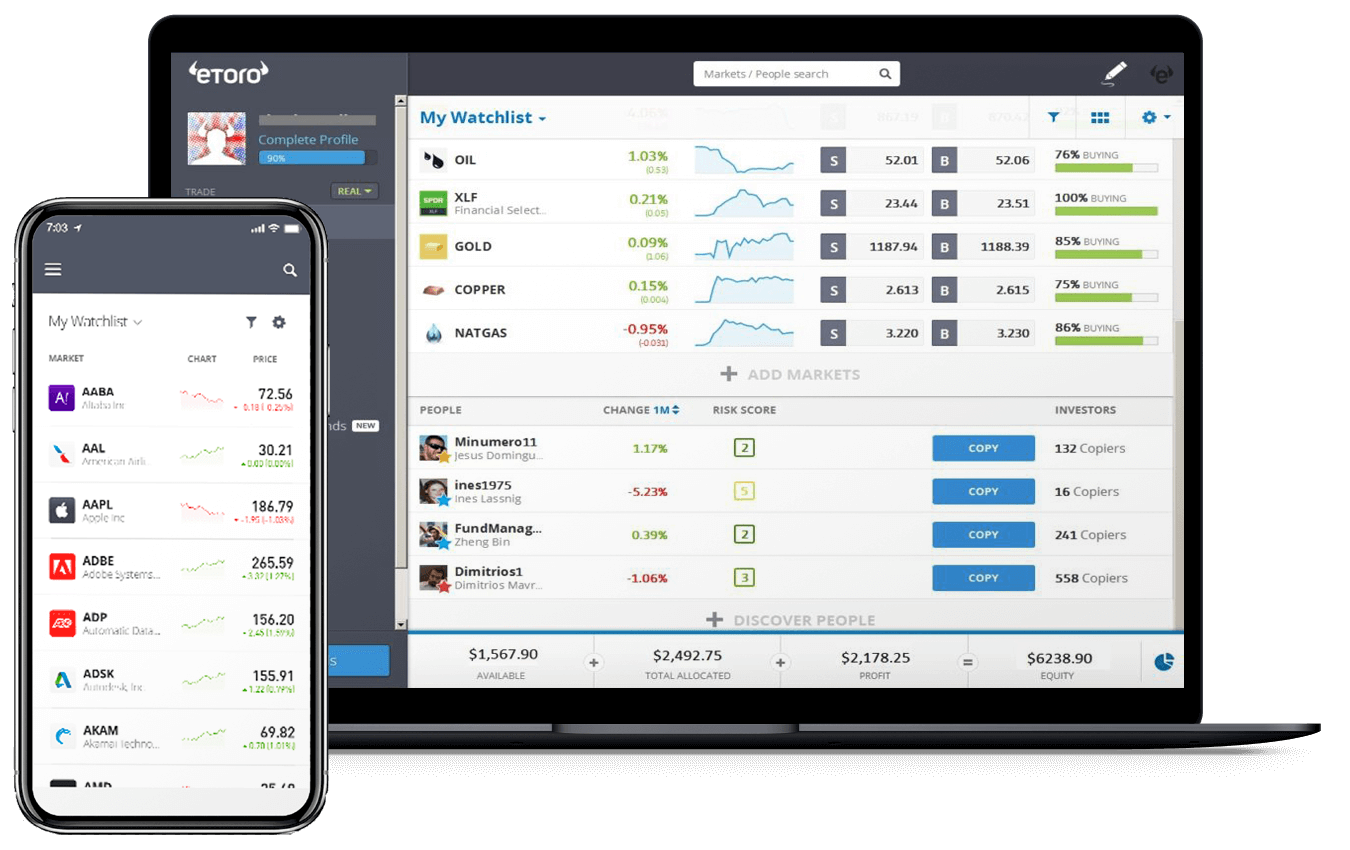

eToro review of trading platforms

eToro only supports its own unique crowd trading platform and has a restricted range of trading platforms. Other brokers often provide a variety of trading platforms, including third-party systems like MT4. When review eToro's crowd trading platform, on the other hand, we know it is user-friendly and well-designed, making it an excellent option for new traders.

eToro review of Web Trader platform

eToro invented the first social trading system and is still the market's largest social trading broker. It provides a diverse range of financial assets to trade and invest in. While making this eToro review and discovered, that the platform is available in over 20 languages and has a clean and straightforward appearance as well as outstanding functionality. It's simple to search for different instruments, and traders may choose from four different order types: market, limit, stop-loss, and trailing stop-loss. Traders may also simply establish price alerts and notifications, as well as customize how their portfolio reports are displayed.

eToro's platform provides traders with a customizable dashboard review of multiple currency pairings to help traders who often trade the same pairs.

Its one-of-a-kind web trader platform fully supports eToro's CopyTrader and CopyPortfolios social trading systems, which are at the heart of the company's products and a tool to make money on eToro. The platform also has the following features:

A Research Tab compiles the collective wisdom of investors and professionals from the world's most prestigious financial organizations.

Procharts is a high-end technical analysis application that allows traders to compare charts from several financial instruments and/or time periods.

70 technical indicators are included in the charting tools.

eToro's platform provides traders with a customizable dashboard review of multiple currency pairings to help traders who often trade the same pairs.

Its one-of-a-kind web trader platform fully supports eToro's CopyTrader and CopyPortfolios social trading systems, which are at the heart of the company's products and a tool to make money on eToro. The platform also has the following features:

A Research Tab compiles the collective wisdom of investors and professionals from the world's most prestigious financial organizations.

Procharts is a high-end technical analysis application that allows traders to compare charts from several financial instruments and/or time periods.

70 technical indicators are included in the charting tools.

eToro Mobile App

While the majority of South African investors choose to use eToro using their regular web browser, some prefer the ability to trade while on the go and this is the way how they make money with eToro. If this describes you, you'll be delighted to learn that eToro South Africa has a fully functional trading app. The mobile application is available for free download and works on both Android and iOS smartphones.

You may use the eToro app review to access almost all of the platform features available on the main desktop website. This involves being able to:

You may use the eToro app review to access almost all of the platform features available on the main desktop website. This involves being able to:

- Assets can be bought, sold, and traded.

- You can deposit and withdraw money.

- Create market and limit orders.

- Examine the worth of your holdings.

- Make more money without being distracted

eToro review Educational resources

To learn more about trading and how to make money, eToro review provides an info about a Trading Academy where novice, intermediate, and expert traders may receive high-quality education. Manuals, webinars, tutorials, videos, and other materials are available through the school.

The following are some of the most important aspects of the eToro Training Academy:

The following are some of the most important aspects of the eToro Training Academy:

- eCourse – These eCourses, designed for novices, are a fantastic source of knowledge about the internet trading industry;

- Live Webinars – eToro invites its clients to participate in live webinars to learn about the nuances of online trading. These seminars contain some really useful advice that are not available anywhere else;

- Training Videos – eToro's videos are perfect for busy traders who don't have the time or patience to go through eCourses or attend live webinars.

- eCourse – These eCourses, designed for novices, are a fantastic source of knowledge about the internet trading industry;

- Live Webinars – eToro invites its clients to participate in live webinars to learn about the nuances of online trading. These seminars contain some really useful advice that are not available anywhere else;

- Training Videos – eToro's videos are perfect for busy traders who don't have the time or patience to go through eCourses or attend live webinars.

eToro's Distinctive Features to help you make more money

Here are some of the characteristics that set eToro apart from the competition:

eToro Tools — To make your trades more successful, employ eToro trading review tools such as the Daily Market Review, eToro Economic Calendar, eToro Earnings Report Calendar, and eToro Professional Client. These tolls will guide you to earning your first big money with eToro.

Social Trading Platform — eToro's social trading platform allows successful traders' trades to be copied. Clients may utilize tools like the Copy People Screen to locate traders to copy from, as well as the Editor's Choice Section to find a list of prominent investors.

Popular Investor Program — The Popular Investor Program was created by eToro to foster a vibrant community of investors and to encourage the best among them to contribute their knowledge, skills, techniques, and experience. eToro pays successful traders who allow others to duplicate their trades with up to 2% of their total assets under management through this program.

Social News Feed — This feature combines the finest social networking aspects, allowing traders to quickly follow traders and financial instruments they like, start a debate with fellow traders, and connect with others in the eToro community.

CopyPortfolios — Clients may invest in two types of Copy Portfolios: Market Portfolios, which include commodities, ETFs, and CFD stocks based on a desired market strategy, and Top Trader Portfolios, which include the most successful traders in the eToro community. Traders may utilize this tool to reduce long-term risks, seize chances for development, and construct diversified portfolios. Clients can also collaborate with eToro to establish their own CopyPortfolio on its platform.

eToro on Social Networking Sites — eToro is present on several social networking sites, including Twitter, Facebook, YouTube, Instagram, and Telegram.

eToro Partners — Those interested in partnering with eToro can drive traffic to the eToro website and make a money generated by the directed traffic for eToro. To assist its partners in driving traffic to eToro, the firm distributes a large amount of marketing material in the form of mailers, banners, and direct links.

eToro Tools — To make your trades more successful, employ eToro trading review tools such as the Daily Market Review, eToro Economic Calendar, eToro Earnings Report Calendar, and eToro Professional Client. These tolls will guide you to earning your first big money with eToro.

Social Trading Platform — eToro's social trading platform allows successful traders' trades to be copied. Clients may utilize tools like the Copy People Screen to locate traders to copy from, as well as the Editor's Choice Section to find a list of prominent investors.

Popular Investor Program — The Popular Investor Program was created by eToro to foster a vibrant community of investors and to encourage the best among them to contribute their knowledge, skills, techniques, and experience. eToro pays successful traders who allow others to duplicate their trades with up to 2% of their total assets under management through this program.

Social News Feed — This feature combines the finest social networking aspects, allowing traders to quickly follow traders and financial instruments they like, start a debate with fellow traders, and connect with others in the eToro community.

CopyPortfolios — Clients may invest in two types of Copy Portfolios: Market Portfolios, which include commodities, ETFs, and CFD stocks based on a desired market strategy, and Top Trader Portfolios, which include the most successful traders in the eToro community. Traders may utilize this tool to reduce long-term risks, seize chances for development, and construct diversified portfolios. Clients can also collaborate with eToro to establish their own CopyPortfolio on its platform.

eToro on Social Networking Sites — eToro is present on several social networking sites, including Twitter, Facebook, YouTube, Instagram, and Telegram.

eToro Partners — Those interested in partnering with eToro can drive traffic to the eToro website and make a money generated by the directed traffic for eToro. To assist its partners in driving traffic to eToro, the firm distributes a large amount of marketing material in the form of mailers, banners, and direct links.

Final thoughts of eToro review South Africa

As it was told in eToro review South Africa, eToro is a well-known online retail forex broker with a good reputation for being dependable, inventive, and regulatory compliance. The worldwide broker is regulated by numerous top-tier bodies, including the UK's premier FCA. eToro review showed, that it allows South African clients and is regarded as a secure platform for trading forex, CFDs, and social copy trading.

eToro is widely considered as the best broker for social copy trading and boasts the world's largest online community of copy traders. The broker has developed a number of ground-breaking eToro trading review tools and continues to be a pioneer in the fintech platform revolution.

eToro is also the finest broker for new traders, owing to its unique CopyTrader platform. The greatest approach to develop your trading techniques is to learn to trade while researching and mimicking how professionals trade.

The worldwide broker provides in-depth market research as well as instructional articles, videos, and podcasts, and encourages you to join the eToro Club and eToro Trading review to help you on your FX and copy trading journey as a novice trader.

eToro is widely considered as the best broker for social copy trading and boasts the world's largest online community of copy traders. The broker has developed a number of ground-breaking eToro trading review tools and continues to be a pioneer in the fintech platform revolution.

eToro is also the finest broker for new traders, owing to its unique CopyTrader platform. The greatest approach to develop your trading techniques is to learn to trade while researching and mimicking how professionals trade.

The worldwide broker provides in-depth market research as well as instructional articles, videos, and podcasts, and encourages you to join the eToro Club and eToro Trading review to help you on your FX and copy trading journey as a novice trader.

MIN. DEPOSIT

FREE DEMO

MAX. RETURN

BONUSES

FOUNDED

$10

Yes

up to 92%

Yes

2014

WEBSITE

Olymp Trade broker rating:

GENERAL RISK WARNING:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

87% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

87% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

OTHER BROKERS COMPARISON: